Go Green: Eco-Friendly HVAC Options for California Residents

Are you concerned about the environmental impact of cooling and/or heating your home? Heating and air conditioning accounts for nearly half of the energy used… View Article Read More

Are you concerned about the environmental impact of cooling and/or heating your home? Heating and air conditioning accounts for nearly half of the energy used… View Article Read More

Protecting electronics from electrical surges is the primary purpose of surge protectors. The metal oxide varistors (MOVs) used in these devices securely channel any excess… View Article Read More

Few homes in Dixon, CA still have standard thermostats with old-fashioned analog controls. Programmable thermostats that can manage multiple pre-set temperature changes are on their… View Article Read More

Ductless mini-split systems boast easy installation owing to their simplified design. Unlike traditional HVAC systems requiring extensive ductwork, these systems consist of an outdoor unit… View Article Read More

California stands at the forefront of the electric vehicle (EV) revolution, championing sustainability and clean energy. With a robust commitment to reducing carbon emissions, many… View Article Read More

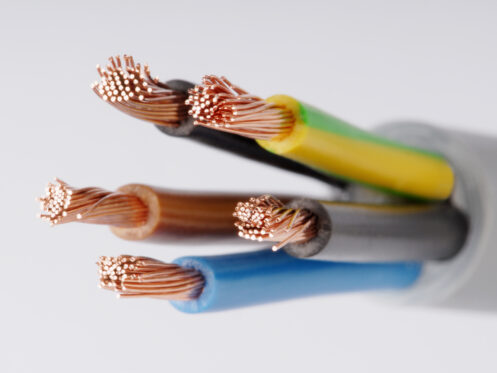

Your Dixon, CA home is powered by electrical energy. If not used correctly, electricity can be a source of fires, electrocution, or other dangerous incidents…. View Article Read More

People are spending more time inside their homes in today’s world, so indoor air quality is becoming more of a concern. In addition to regularly… View Article Read More

Maintaining a comfortable and conducive indoor environment is a paramount concern for any homeowner or business owner. In the bustling Solano and Yolo Counties where… View Article Read More

What are your plans for Valentine’s Day this year? You may want to stock up on tissues, but not because the romance is bound to… View Article Read More

When the summer gets going in the Sacramento Valley area and the sun starts beating down on your house, you need relief! If you’ve been… View Article Read More